US President Donald Trump has announced new import taxes of 25% on cars and car parts coming into the US in a move that threatens to widen the global trade war.

Trump said the latest tariffs would come into effect on 2 April, with charges on businesses importing vehicles starting the next day. Charges on parts are set to start in May or later.

The president claimed the measure would lead to “tremendous growth” for the car industry, promising it would spur jobs and investment in the US.

But analysts have said the move is likely to lead to the temporary shutdown of significant car production in the US, increase prices, and strain relations with allies.

The US imported roughly eight million cars last year, accounting for about $240bn (£186bn) in trade and roughly half of overall sales.

Mexico is the top foreign supplier of cars to the US, followed by South Korea, Japan, Canada and Germany. Trump’s latest move threatens to upend global car trade and supply chains.

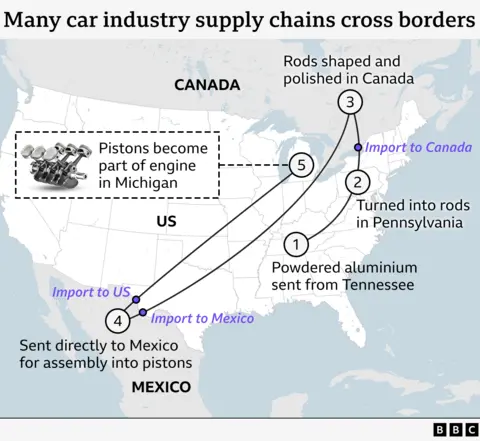

Many US car companies have operations in Mexico and Canada as well, set up under the terms of the longstanding free trade agreement between the three countries.

The White House said the order would apply not only to finished cars but also to car parts, which are often shipped in from other countries before getting assembled in the US.

However, the new tariffs on parts from Canada and Mexico are exempt while US customs and border patrol set up a system to assess the duties, the White House said. The neighbouring countries see goods worth billions cross borders each day.

On Wednesday, shares in General Motors slid roughly 3%. The sell-off spread to other companies, including Ford, after the president’s remarks as he confirmed the tariffs.

Asked at a press conference if there was any chance he would reverse course, Trump said no, adding later: “This is permanent.”

“If you build your car in the United States there is no tariff,” he said.

Japanese Prime Minister Shigeru Ishiba said his government would put “all options on the table” in response to the tariffs.

Japan, which is home to several major motor industry giants, is the world’s second largest exporter of cars.

Shares in Japanese carmakers – including Toyota, Nissan, Honda – fell in early trade in Tokyo.

A tariff is a tax on imports collected by a government and it is paid by the company importing the good.

Trump has embraced the tool, looking to apply it to a host of goods being imported into the US as part of a wider drive to protect American businesses and boost manufacturing.

But while the measures can protect domestic businesses, they also raise costs for businesses reliant on parts from abroad, as is the case for car-makers.

Analysts have estimated that the cost of a car could rise thousands of dollars, with 25% tariffs on parts from Mexico and Canada alone adding $4,000-$10,000 in cost depending on the vehicle, according to the Anderson Economic Group.

Also See: US Stocks Tumble, Worsening Losses As Trump Threatens Tariffs on Wine

‘Direct attack’

The fresh car import taxes on cars are set to come into force on the same day as so-called reciprocal tariffs kick in for individual countries based on their trading relationship with the US.

It is not clear how the car tariffs might affect those plans.

But many countries, including the UK, are concerned about their exporters being hit as a result of the new taxes.

The US was the top sales market for British-based Jaguar Land Rover last year, with the carmaker selling 116,294 vehicles to Americans, exceeding sales to customers in the UK and China.

The UK government is in talks with the US administration and remains hopeful of a trade deal before tariffs come into force, the BBC understands. Watch: Automobile tariffs a ‘direct attack’, says Canadian PM Mark Carney

Canadian Prime Minister Mark Carney called Trump’s announcement a “direct attack” on his country and its car industry.

“This will hurt us, but through this period by being together we will emerge stronger,” he said.

European Commission president Ursula von der Leyen said the bloc would consider the measures before any potential response.

“As I have said before, tariffs are taxes – bad for businesses, worse for consumers equally in the US and the European Union,” she said.

“The EU will continue to seek negotiated solutions, while safeguarding its economic interests.”

Early on Thursday, Trump threatened “far larger” tariffs if the European Union and Canada worked together to do what he described as “economic harm” to the US.

For the UK, the US is the second largest car export market after the EU, with mainly luxury carsshipped across the Atlantic, according to the industry body, the Society of Motor Manufacturers and Traders (SMMT).

Mike Hawes, the chief executive of the SMMT, urged the UK and US governments to “come together immediately and strike a deal that works for all”.

The car industry was already grappling with expanded tariffs on steel and aluminium that Trump put in place earlier this month.

In recent weeks, major car companies such as Ford and General Motors had urged the president to exempt the industry from any further duties.

A 2024 study by the US International Trade Commission predicted that a 25% tariff on imports would reduce imports by almost 75%, while increasing average prices in the US by about 5%.

But Trump has proceeded with the move, which is a revival of an action he first considered during his first term in the White House.

White House officials said it wanted to see US workers make more parts, not simply assemble them, and have maintained their action is pushing firms to relocate.

A day before the latest tariffs, South Korean carmaking giant Hyundai announced it would invest $21bn (£16.3bn) in the US and build a new steel plant in the southern state of Louisiana.

Trump hailed the investment as a “clear demonstration that tariffs very strongly work”.

United Autoworkers union leader Shawn Fain, who had opposed Trump in the election, praised the president’s actions, saying he was “stepping up to end the free trade disaster that has devastated working class communities for decades”.

Elsewhere, the head of trade group the American Automotive Policy Council, Matt Blunt, said: “US Automakers are committed to President Trump’s vision of increasing automotive production and jobs in the US.”

This news is sourced from BBC and is intended for informational purposes only.

![Trump imposes 25% tariffs on cars, escalating the trade war and disrupting global auto prices, supply chains, and production. [Image via AFP]](https://southasiatimes.org/wp-content/uploads/2025/03/000_37ZZ86W.webp)

![Ukrainian and Russian flags with soldier silhouettes representing ongoing conflict. [Image via Atlantic Council].](https://southasiatimes.org/wp-content/uploads/2026/02/2022-02-09T000000Z_1319661209_MT1NURPHO000HXCNME_RTRMADP_3_UKRAINE-CONFLICT-STOCK-PICTURES-scaled-e1661353077377.jpg)