When we look at Pakistan’s economic data, it shows promising numbers that give confidence to the people of Pakistan that the country may be emerging from an economic downturn. However, ground realities tell a different story. Despite these promising indicators, where is this gap coming from? What are the leakages in the economy that still prevent a full recovery? An exploration of these underlying issues is as follows.

Recent Economic Indicators

The June 2024 monthly economic update and outlook report stated that year-over-year (YOY) inflation was 11.8% in May 2024, a considerable improvement from 38.0% in the same month last year. Similarly, the current account balance has also seen improvement in this report. While the short-term growth prospects have modestly improved, the overall economic outlook remains weak when compared to past performances for both advanced economies and emerging markets and developing economies (EMDEs).

The June 2024 report highlighted that although inflation had risen slightly from the previous month, it was still well below the levels seen last year.

Nevertheless, according to a Pulse Consultant survey, 74% of urban Pakistanis found it difficult to cover their expenses with their current income, 44.4% had reduced grocery purchases to make ends meet, 29.6% were borrowing monthly, 7.4% were taking on extra jobs, and only 11.6% could save money. The challenges facing even the middle class are widely evident, despite reports and government policies painting a picture of economic improvement.

Pakistan Economic Recovery: Government Measures to Combat Inflation

To combat inflation, the government has implemented several administrative, legislative, and relief measures. On June 1, authorities reduced gasoline prices by Rs4.74 per litre and diesel prices by Rs3.86 per litre. They implemented additional reductions on June 15, lowering gasoline prices by Rs10.20 and diesel prices by Rs2.33 per litre. These price controls are part of the government’s strategy to stabilise inflation, manage supply and demand, and reduce market volatility.

The economy showed moderate signs of recovery in the fiscal year ending June 2024. Government-led policy management has aimed to rebuild market confidence, sparking economic activity. GDP growth for FY2024 reached 2.4%, with 6.3% growth in agriculture and 1.2% growth in the industrial and service sectors, reflecting a diverse growth pattern.

Since July 2023, the Pakistan Stock Exchange (PSX) has experienced a remarkable surge of 79.5%, with the KSE 100 index reaching 78,810 points by June 21, 2024.

To further stimulate external investment flows, the Pakistani government has actively engaged with international financial institutions. In September 2024, the International Monetary Fund (IMF) approved a 37-month Extended Fund Facility (EFF) loan for Pakistan, amounting to approximately $7 billion. The initial disbursement of $1 billion is expected to occur immediately, with the remaining funds distributed over the subsequent three years. This loan aims to support Pakistan in stabilising its economy and addressing ongoing financial challenges.

Challenges to Pakistan Economic Recovery

However, if economic recovery is visible, why does the economic outlook remain challenging? Several factors—including weak institutions, political instability, a large informal sector, corruption, and a lack of accountability—hinder steady progress. For instance, Pakistan’s informal economy is estimated to contribute 35.6% of GDP, or $661 billion (PPP), undermining the formal economy. The informal economy, which accounts for 56% of Pakistan’s GDP, reportedly employs 80% of domestic workers engaged in informal employment that includes small-scale farming, retail, and domestic work. While this sector is vital for livelihoods, it negatively impacts economic growth due to tax avoidance. Comparatively, while the informal economy in India employs 90% of its workforce and reportedly 30% in China, effective policies in these countries mitigate its negative impact. In Pakistan, however, the informal sector remains a critical barrier to growth.

Also See: Narcotics Trafficking: Toll on Pakistan’s Economy and Stability

Governance and Corruption Issues

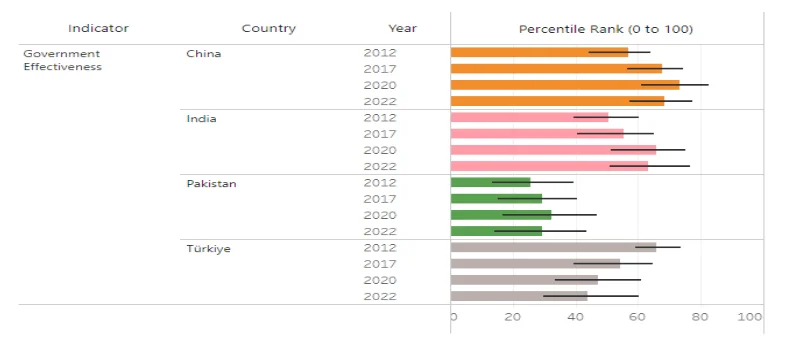

On the other hand, when we look at Pakistan’s government’s effective policies, the absence of competent governance has led to suboptimal policy execution, resource mismanagement, inadequate public service provision, and diminished faith in governmental institutions.

Figure 1 below compares Pakistan’s governance effectiveness with its peers:

Pakistan’s challenges largely stem from weak institutions, political instability, the informal sector, corruption, and a lack of accountability. The nation’s institutions—such as the courts, police, and bureaucracy—often face inadequate funding, personnel, and resources. To improve governance, it is essential to enhance institutions, foster transparency, increase public engagement, collaborate with civil society organisations, the media, and the private sector, and invest in infrastructure and social services.

Corruption and Its Impact on Business

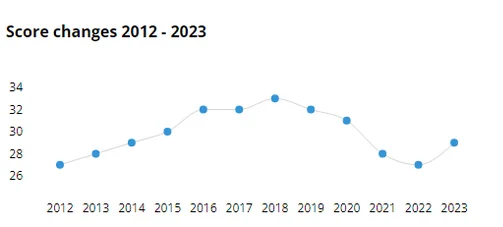

Corruption remains a significant concern. Despite a slight improvement in Pakistan’s Corruption Perception Index (CPI) score—ranking 133 in 2023, up from 140 in 2022—this progress is minimal, and corruption has become normalised in society. Many no longer hesitate to engage in corrupt practices. As Transparency International emphasises, it is vital to provide judicial systems with the independence, resources, and transparency needed to combat corruption effectively.

Figure 2 shows Pakistan’s corruption levels since 2012

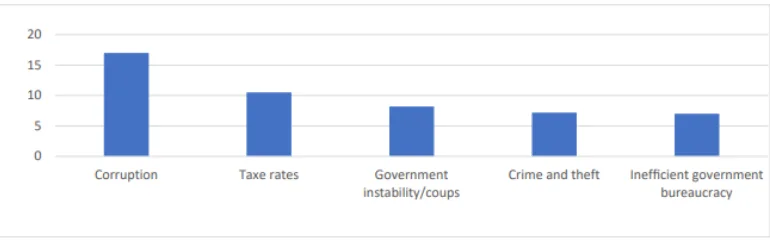

Corruption has complicated the business landscape in Pakistan, prompting many individuals to seek opportunities abroad. Overly restrictive laws and obstacles to market entry have hindered local and foreign investments. The figure below highlights key concerns investors face in Pakistan, with corruption being the most significant issue.

Figure 3. Concerns with Governance Top Investor Complaints Regarding Doing Business in Pakistan

Budget Highlights and Future Directions

The key highlights of Pakistan’s Federal Budget for 2024–2025 indicate the government’s intention to transition towards a market-driven economic paradigm. The government aims to reduce wasteful spending and increase revenue. Key initiatives include reforms to the pension system. The budget also outlines the privatization of state-owned enterprises and support for the IT and agriculture sectors.

The minimum wage has been raised from Rs. 32,000 to Rs. 37,000. The ILO’s latest labour market update points to the growing labour market challenges stemming from Pakistan’s economic crisis.

Strategic Initiatives for Sustainable Growth

Progressive tax measures are set to be implemented, emphasising a shift from a government-dominated economy to a market-driven one. The government is prioritising high-potential industries such as IT, SMEs, mining and minerals, travel, exports, and agriculture, which are expected to yield significant dividends and support the nation’s balance of payments.

To achieve sustainable growth in the coming years, a careful balance of budgetary restraint, effective implementation of a homegrown growth program, and international collaboration will be essential. Encouraging entrepreneurship, investing in skill development, and formalising the informal sector through government incentives can help excluded groups access better jobs and earn higher incomes.However, mafia pricing remains uncontrolled, disrupting the economic structure. To enhance governance in Pakistan, it is crucial to improve institutions, foster transparency, increase public engagement, collaborate with civil society organisations, the media, and the private sector, and invest in infrastructure and social services. As Acemoglu, Johnson, and Robinson (2005) argue in the Handbook of Economic Growth, elite groups benefiting from the existing political and economic systems may obstruct institutional reforms in a context of unequal power distribution. These strategies must be implemented comprehensively and consistently to ensure lasting transformation.

The views expressed in this article are the author’s own. They do not necessarily reflect the editorial policy of the South Asia Times.

![Pakistan economic recovery appears stable on paper, but the stark contrast with harsh realities prompts critical questions about sustainability. [Image via Business Recorder]](https://southasiatimes.org/wp-content/uploads/2024/11/62083cc68ffdb.webp)