US President Donald Trump has threatened a 200% tariff on any alcohol coming to the US from the European Union (EU) in the latest twist of an escalating trade war.

The threat is a response to the EU’s plans for a 50% tax on imports of US-produced whiskey as part of its retaliation to Trump’s tariffs on all steel and aluminium imports to the US.

The US president called for the immediate removal of the EU’s “nasty” tariff on US whiskey, calling the bloc “hostile and abusive” and “formed for the sole purpose of taking advantage of the United States”.

A European Commission spokesperson said that “calls are being prepared” between between the US and the EU to discuss the situation.

It confirmed that its trade commissioner, Maroš Šefčovič, had “reached out to his American counterparts” after Trump’s latest threat.

The stand-off marked another escalation of a trade war which has rattled financial markets and raised concerns over the impact on the economies and consumers in many countries around the world, including the US.

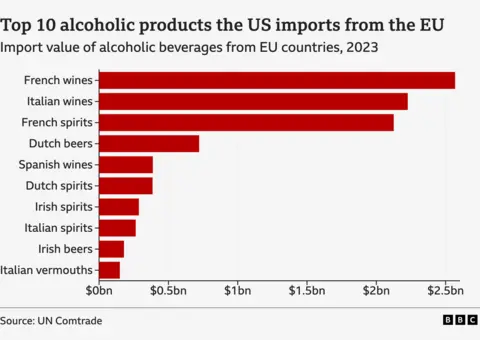

Europe sends more than €4.5bn ($4.89bn; £3.78bn) worth of wine each year to the US, which is its largest export market, according to the Comité Européen des Entreprises Vins, which represents the European wine industry.

Ignacio Sánchez Recarte, secretary-general of the group, said if Trump carried through on his threats, it would destroy the market, costing thousands of jobs.

“There is no alternative to sell all this wine,” he said, pleading with the two sides to “keep wine out of this fight”.

The latest clash came after new US tariffs on steel and aluminium came into effect on Wednesday, hitting imports of the metals with a blanket duty of 25% and ending exemptions from the duties that the US had previously granted for shipments from some countries, including from the EU and Canada.

Canada and Europe – which are among America’s biggest trade partners – called the new taxes unjustified and struck back with their own tariffs on a range of US products. The EU’s measures are due to go into force 1 April.

Theclash reprises a battle that played out during Trump’s first term, when he first announced tariffs on steel and aluminium.

The EU responded with its own tariffs, including a 25% tax on American whiskey.

In the aftermath, whiskey sales to the EU dropped 20%, falling from roughly $552m in 2018 to $440m in 2021, according to the Distilled Spirits Council of the US. Trump in turn

The tariffs were lifted after Trump left office, after the two sides reached an agreement that exempted a certain amount of European metals from the duties.

But Trump has indicated little appetite for deal-making so far, at least when it comes to steel and aluminium.

“If this Tariff is not removed immediately, the US will shortly place a 200% Tariff on all wines, champagnes & alcoholic products coming out of France and other EU represented countries,” he wrote on social media, using all capital letters for some of the message.

Also See: Trump Threatens Further Tariffs as EU, Canada Retaliate

‘It’s giant threat to our livelihoods’

The targeting of wine and whiskey is symbolic – there are few consumer goods more iconic than French Bordeaux or Tennessee whiskey. From a value standpoint, drinks trade is worth less than some of the other items facing tariffs.

But Mary Taylor, a US-based importer of European wines, said the measures would be catastrophic for her business and industry, with an impact that would ripple out to restaurants, bars and distributors across the US.

“It just looks like a big, giant threat to our livelihoods,” she said.

Ms Taylor, who brings in 2 million bottles a year, weathered the 25% tariff Trump put on certain EU bottles during his first term by expanding her distribution in Europe, but she said, “200% is a whole different ball game”.

Shares in the US fell again on Thursday.

The S&P 500 dropped nearly 1.4%, taking it down roughly 10% from its most recent peak – a milestone known as a correction. The Dow slumped 1.3%, while the Nasdaq dropped almost 2%.

In Europe, London’s FTSE 100 was flat, while Germany’s Dax ended about 0.5% lower.

In Paris, the Cac 40 fell 0.6%, as shares of major spirit-makers were hit, with Pernod Ricard down 4% and Hennessy cognac maker LVMH falling 1.1%.

In interviews with US business media on Thursday, White House officials blamed the EU for escalating the dispute.

“Why are Europeans picking on Kentucky bourbon or Harley-Davidson motorcycles? It’s disrespectful,” Commerce Secretary Howard Lutnick told Bloomberg Television, describing the back-and-forth as “off the topic”.

Treasury Secretary Scott Bessent warned that a trade war was likely to inflict more economic pain on the EU than on the US, dismissing concerns that the clash could spiral.

“One or two items, with one trading bloc – I’m not sure why that’s a big deal for the markets,” he said.

In an interview with the BBC’s HardTalk, European central bank president Christine Lagarde, said that the EU had “no choice” but to retaliate.

“At the moment, everybody is positioning,” she said, adding that she expected the two sides to sit down and negotiate.

“Everybody will suffer” if the dispute were to develop into a full blown trade war, she warned.

So far, Trump has shown little tolerance for retaliation from countries over the tariffs he has introduced.

Earlier this week, he blasted Canada with the threat of a 50% tariff on its steel and aluminium after the Canadian province of Ontario responded to new tariffs with a surcharge on electricity exports to the US.

He rescinded that threat after Ontario agreed to suspend the charges.

Former Trump adviser Stephen Moore, now an economist with the Heritage Foundation, said he thought the EU would have to make a concession to defuse the situation, noting that Trump had consistently voiced concerns about rules on agricultural products.

“Absolutely this is going to end up with a deal,” he said. “It’s only a question if it ends up in a deal in a day, a week, a month or six months, but there will eventually be a negotiated settlement.”

This news is sourced from BBC and is intended for informational purposes only.

![Trump threatens a 200% tariff on EU alcohol as US-EU trade war escalates over steel, whiskey tariffs, and retaliatory measures. [Image via Getty Images]](https://southasiatimes.org/wp-content/uploads/2025/03/142cb480-0016-11f0-8d1c-b19460b8e7fb.jpg.webp)